The New Way to Invest in Private Equity

How modern platforms eliminate the J-curve, capital calls, and million-dollar minimums—while maximizing tax efficiency.

People overcomplicate private equity. Try this instead:

It used to be that you could only access private equity funds with $5 million minimums.

That’s way too high for most investors to stay diversified across managers, vintages, and sectors.

And if you’re only investing in one or two PE funds — don’t.

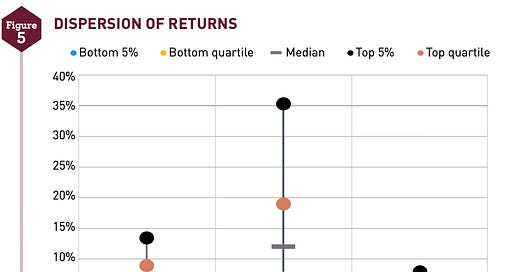

The dispersion of outcomes is massive. You want exposure to hundreds of companies to put yourself in the best mathematical position for success.

Traditionally, private equity meant committing capital to a drawdown-style fund — where you:

Pledge capital upfront

Wait for the manager to call it over time

Pay fees while your cash sits idle

And suffer through the dreaded J-curve as your returns start negative

If you wanted to invest in PE the right way, that meant dealing with dozens of funds, hundreds of capital calls, and holding cash on the sidelines just to be ready.

I worked at a firm that did this. It was a nightmare.

But things have changed.

Thanks to technology and innovation, that entire model is being disrupted.

Today, we can invest immediately in portfolios of hundreds of private companies, diversified by sector, style, region, and vintage — with:

No J-curve

No capital calls

No $5 million minimums

And one of my favorite parts?

We can now hold private equity inside Roth IRAs — something that used to be nearly impossible. Not anymore.

That means gains can compound for decades with no taxes getting in the way.

And if you’re investing from a taxable account, there’s still a way to manage the tax drag:

By pairing private equity with a long/short SMA for your public equities, we can systematically harvest losses and offset capital gains, including gains from private exits.

NOW we’re cooking with gas!